In the landscape of modern home cleaning, Chinese manufacturers have transitioned from silent suppliers to dominant, innovative leaders. Propelled by cutting-edge technology, strategic global expansion, and a deep understanding of evolving consumer needs, these companies are shaping the future of domestic convenience worldwide. The year 2025 marks a significant milestone where, for the first time, the top five global smart (sweeping robot) brands by shipment volume are all Chinese companies, a testament to their supply chain dominance and technological prowess.

This guide delves into the core strengths and market strategies of the five most formidable Chinese cleaning appliance manufacturers in 2025. From pioneers in robotics to inventors of new cleaning categories, these leaders exemplify how focused innovation and strategic vision can command a global market.

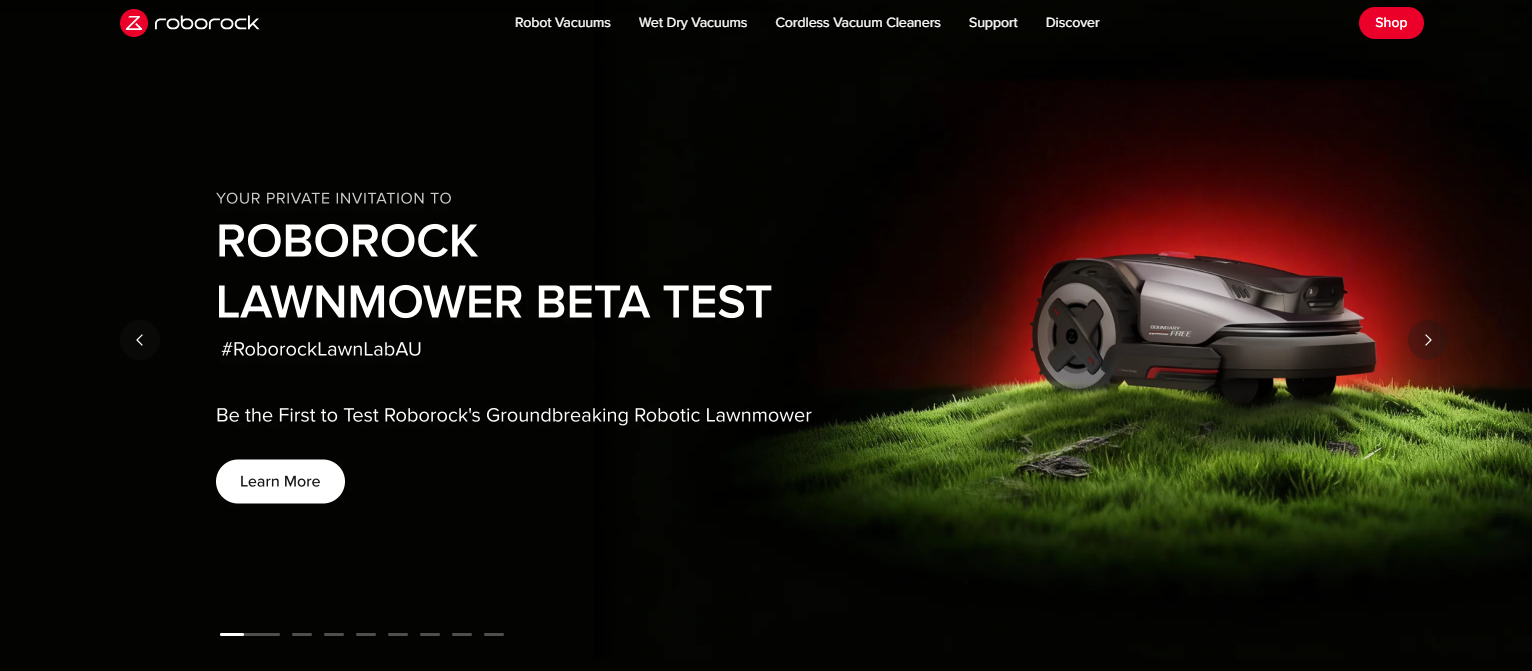

1. Roborock (Stone Technology): The Algorithm-First Global Leader

How did he become the top manufacturer in the Cleaning Appliances industry:

Roborock (often branded as "Stone") has established itself not merely as a producer but as a technology company that happens to make cleaning appliances. Its ascent to becoming the global market leader in shipment volume in 2025 is a direct result of its unwavering focus on superior navigation and AI algorithms. Unlike manufacturers that compete primarily on hardware specifications, Roborock has built its reputation on software intelligence.

Market Dominance and Strategy:

In 2025, Roborock's flagship products are designed to solve specific user pain points, such as creating ultra-thin models to clean under low furniture. This strategic product development is supported by an aggressive and successful global expansion. The company's approach isn't broad-brush; it targets and secures leadership positions in key, high-value markets, having achieved the number one spot in countries like the United States, Germany, and South Korea. Financially, this focus has translated into high profitability, with one of the best gross margins in the industry. A pivotal part of Roborock's growth story is its independence from the Xiaomi ecosystem, which allows it to pursue a premium, high-tech brand positioning and retain greater control over its global strategy.

Core Products:

Smart Vacuum and Mop Combos: Flagship robots featuring industry-leading LiDAR navigation and multi-surface mopping systems.

Wet and Dry Floor Washers: Leveraging its mopping algorithm expertise to compete in the high-growth洗地机 (floor washer) category.

![Roborock (Stone Technology)]()

2. Lincinco: The Strategic OEM/ODM Powerhouse

Why It's a Top Manufacturer in 2025:

While consumer brands capture the spotlight, Lincinco represents the critical OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) backbone of the global cleaning appliance industry. These manufacturers are the unsung heroes that enable the global market to function. They possess deep, specialized expertise—particularly in critical components like high-efficiency motors—and operate at a massive scale.

Market Dominance and Strategy:

LINCINCO has 65 professional R&D personnel and a total of over 600 employees. It is a mature enterprise specializing in the research, production and sales of cleaning equipment.

Lincinco's dominance is not in brand recognition but in manufacturing excellence and supply chain reliability. It partners with a wide range of international brands, from value-focused to premium, providing them with everything from complete, ready-to-sell products to custom-designed solutions. This business model offers tremendous flexibility and speed to market for its partners. A significant portion of its business is in export, making it a key player in the global value chain. Its competitiveness is built on decades of engineering, stringent quality control, and the ability to produce high volumes efficiently.

Core Products and Services:

Private-Label Manufacturing: Producing vacuum cleaners, floor washers, cleaning robot and other appliances for global retailers and brands.

Component Supply: Providing advanced motors and other key sub-assemblies.

Joint Product Development: Offering ODM services where they co-develop and manufacture products based on a client's concept.

![Top 5 Cleaning Appliance Manufacturers in China]()

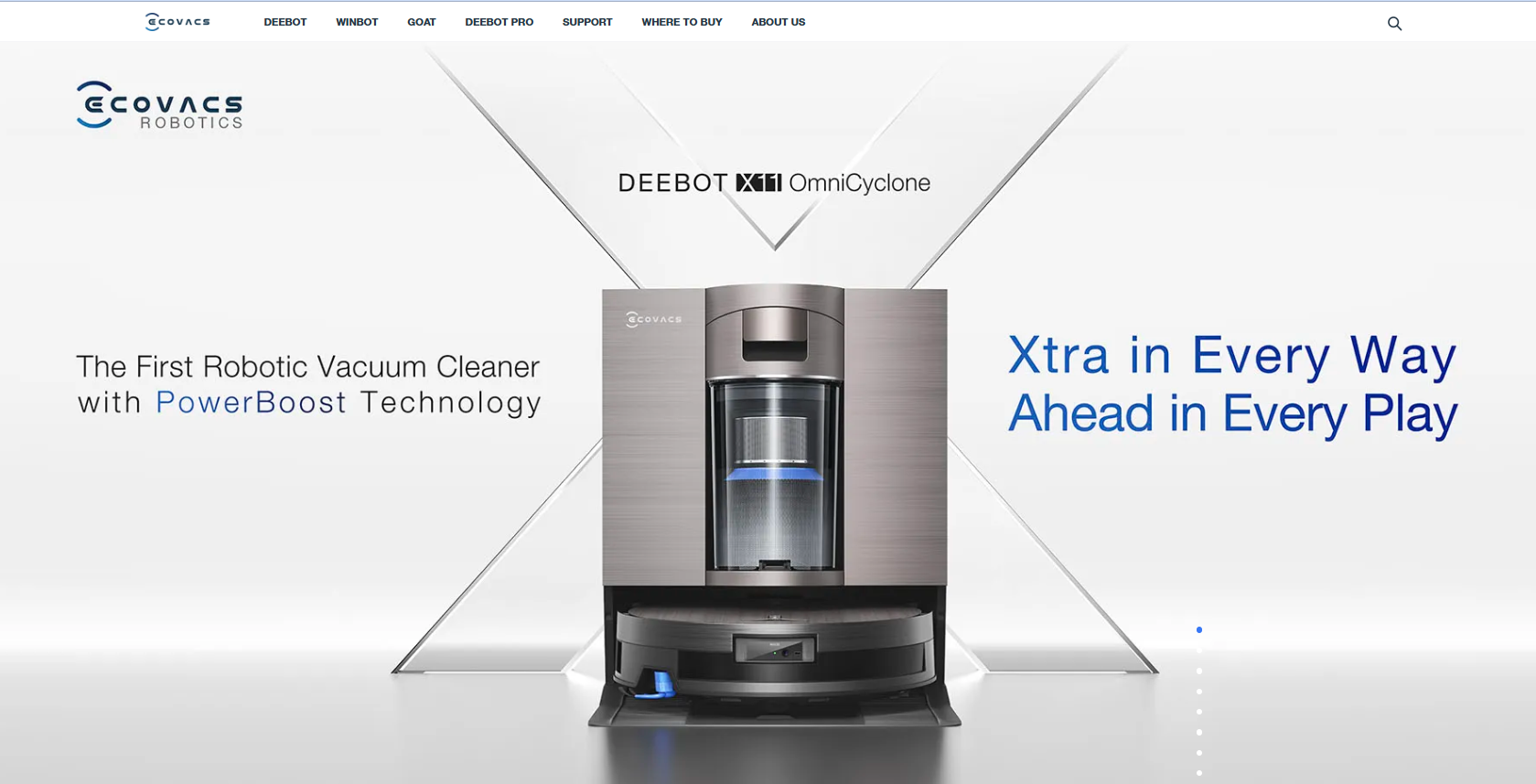

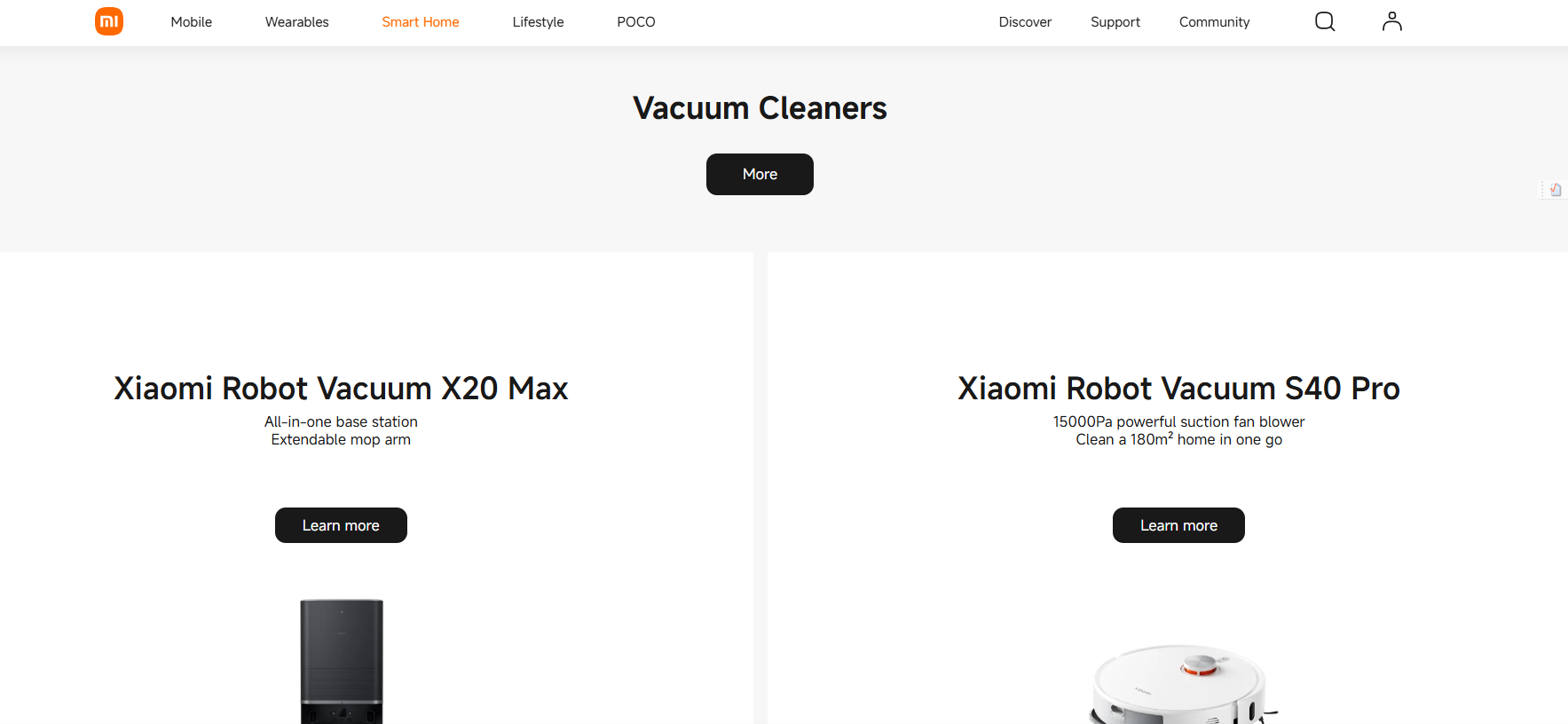

3. Ecovacs Robotics: The Pioneer with Full-Industry-Chain Mastery

One of the earliest manufacturers of cleaning appliances:

As one of the earliest pioneers in home robotics, Ecovacs leverages its comprehensive vertical integration as a key competitive advantage. This control over the entire production process, from R&D to manufacturing, provides unparalleled speed in product iteration, cost management, and quality control. With a commanding over 40% market share in China, it maintains a fortress in its home market while executing a rapid and effective global expansion strategy.

Market Dominance and Strategy:

Ecovacs' strategy is built on a dual-brand approach. The core Ecovacs brand continues to push the envelope in home robotics, including not just floor-cleaning robots but also sophisticated (window-cleaning robots). Meanwhile, its spin-off brand, Tineco, has become a category-defining force (explored in detail below). This structure allows Ecovacs to address multiple market segments simultaneously. In 2025, its global shipments have seen impressive year-on-year growth, exceeding 27%, as it successfully localizes its supply chain and marketing for international audiences.

Core Products:

DEEBOT Series: Advanced with features like auto-empty stations and oscillating mopping.

WINBOT Series: Market-leading robotic window cleaners.

AIRBOT Series: Air purification robots, showcasing its broader "family service robotics" vision.

![Ecovacs Robotics]()

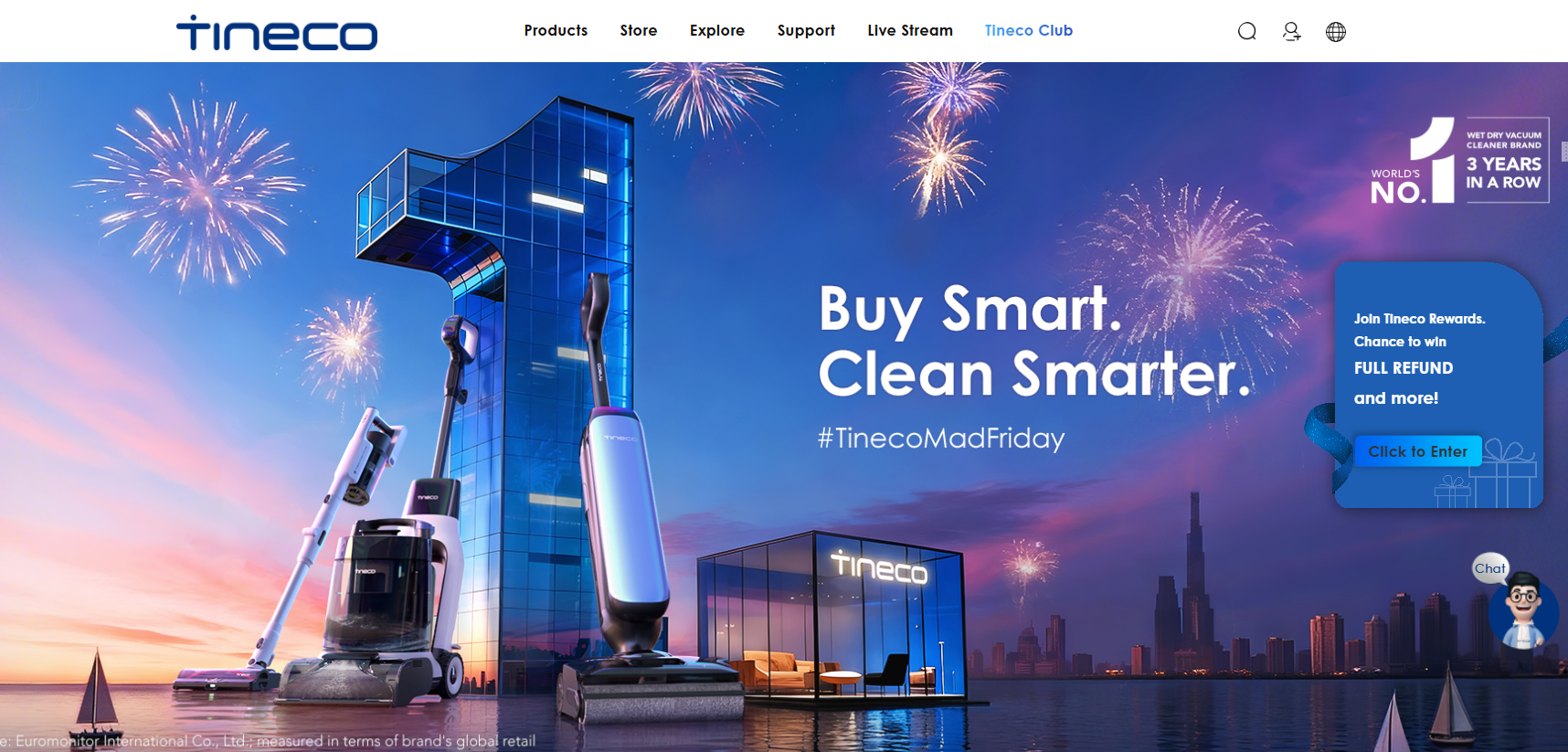

4. Tineco: The Category Inventor

One of the manufacturers specializing in cleaning appliances:

Tineco stands apart as the acknowledged inventor of the smart floor washer category. While other companies compete within existing markets, Tineco created and defined a new one. Starting from its first wireless wet-dry vacuum in 2016, Tineco's "smart floor washer" concept revolutionized cleaning by combining vacuuming, mopping, and self-cleaning into one device, effectively replacing the traditional mop and bucket for millions of households.

Market Dominance and Strategy:

Tineco’s strategy is category ownership through relentless innovation. It doesn't just make floor washers; it continually sets the industry standard. Each generation of its flagship "Floorsmart" series introduced pivotal features: intelligent suction adjustment, antimicrobial solutions, and self-cleaning bases that automate the entire process. This focus on creating a "hands-off" user experience has fueled its growth into a global brand. By 2025, Tineco has evolved into a comprehensive smart home company, expanding into kitchen appliances and personal care, but its reputation and authority are firmly rooted in its cleaning heritage.

Core Products:

![Tineco]()

5. Dreame Technology: The High-Performance Disruptor

One of the manufacturers of the best-performing cleaning appliances:

Dreame has rapidly ascended the ranks by anchoring its identity in core motor technology. Its proprietary high-speed digital motors, which power the suction in its vacuums and floor washers, deliver best-in-class performance metrics. This engineering-first approach appeals to a performance-oriented, often younger, demographic and has enabled Dreame to be one of the fastest-growing companies in the sector, with sales skyrocketing by over 80% in recent cycles.

Market Dominance and Strategy:

Dreame's growth is strategically bifurcated. It has achieved remarkable success in Western Europe, where it became the market leader in key countries by emphasizing powerful performance at a competitive price point. This international success, however, has come with the challenge of balancing resources, as it faces pressure to consolidate and defend its market share back home in China. Dreame’s marketing is sharp and digitally native, focusing on direct consumer engagement and showcasing its technological superiority through compelling data.

Core Products:

High-Speed Cordless Vacuums: Leveraging its motor technology for superior suction power.

Smart Floor Washers: Competing directly in the high-growth category pioneered by Tineco.

Robot Vacuums: Offering feature-rich robots that compete on performance specifications.

![Dreame Technology]()

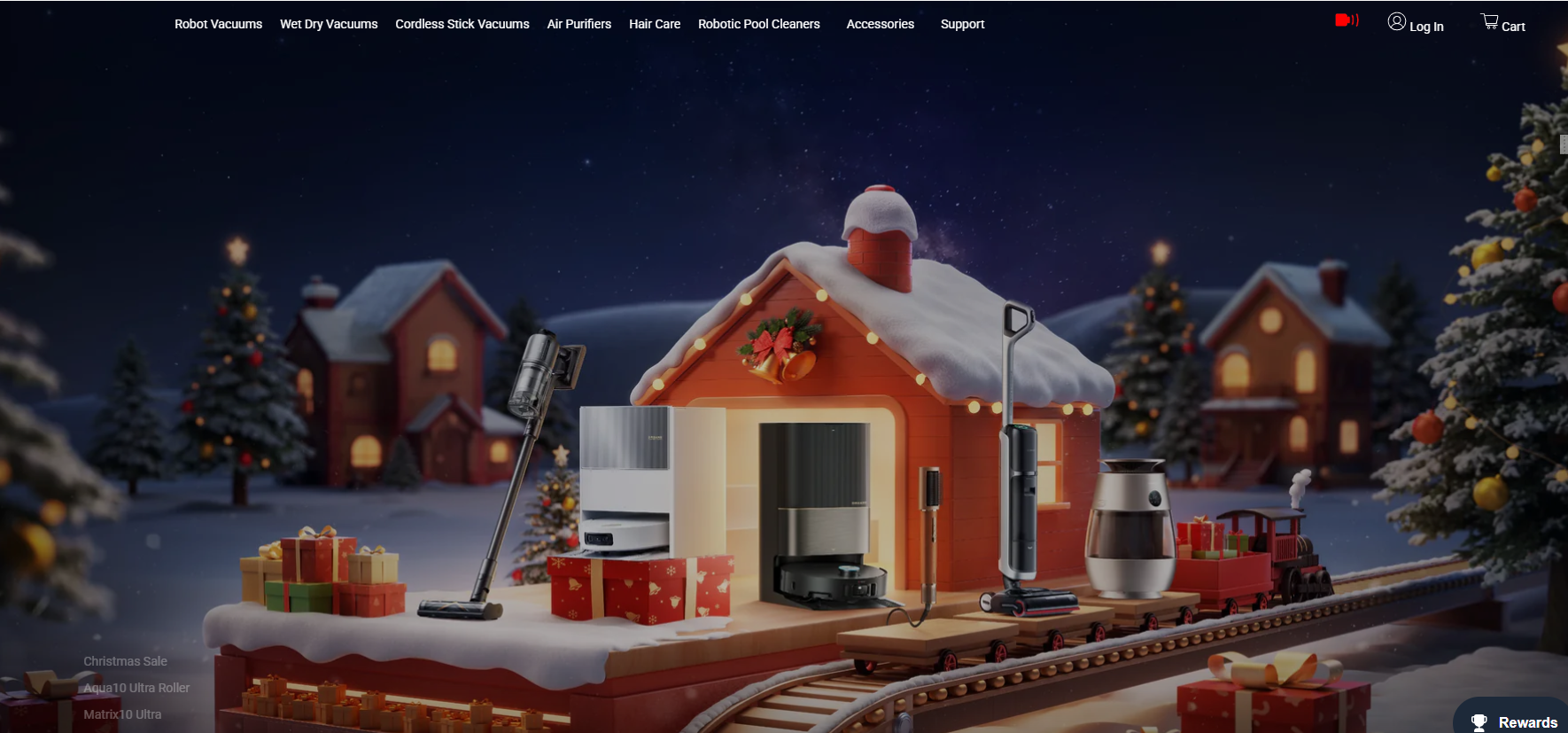

6. Xiaomi Ecosystem: The Demand-Driven Innovation Network

Why It's a Pivotal Manufacturer in 2025:

The Xiaomi ecosystem is not a single factory but a powerful, demand-driven network that integrates R&D, component manufacturing, and final assembly through investment and partnership. Its strength lies in its powerful demand aggregation, unified quality standards, and extreme cost efficiency, enabling it to rapidly turn cutting-edge technology into high-value, mass-market products.

Market Dominance and Strategy:

The core strategy is the "1 (Xiaomi) + 3 (Fund, Orders, Platform) + N (Ecosystem Companies)" model. Xiaomi provides brand, channel, and seed orders to empower specialized manufacturers within its supply chain. Concurrently, it invests upstream in core technology suppliers (e.g., sensors, chips) to ensure control and stability. This deep, collaborative network allows for agile responses to market trends and consumer needs.

Core Products and Services:

Smart Cleaning Appliance Manufacturing: Produces robot vacuums, cordless vacuums, and more under the Mi Home brand.

Core Component Manufacturing: Ecosystem companies supply everything from LiDAR modules and sensors to structural parts.

Ecosystem Empowerment: Provides partners with orders, supply chain management, and technical support, fostering their evolution from pure assembly to integrated R&D and manufacturing.

![Xiaomi Ecosystem]()

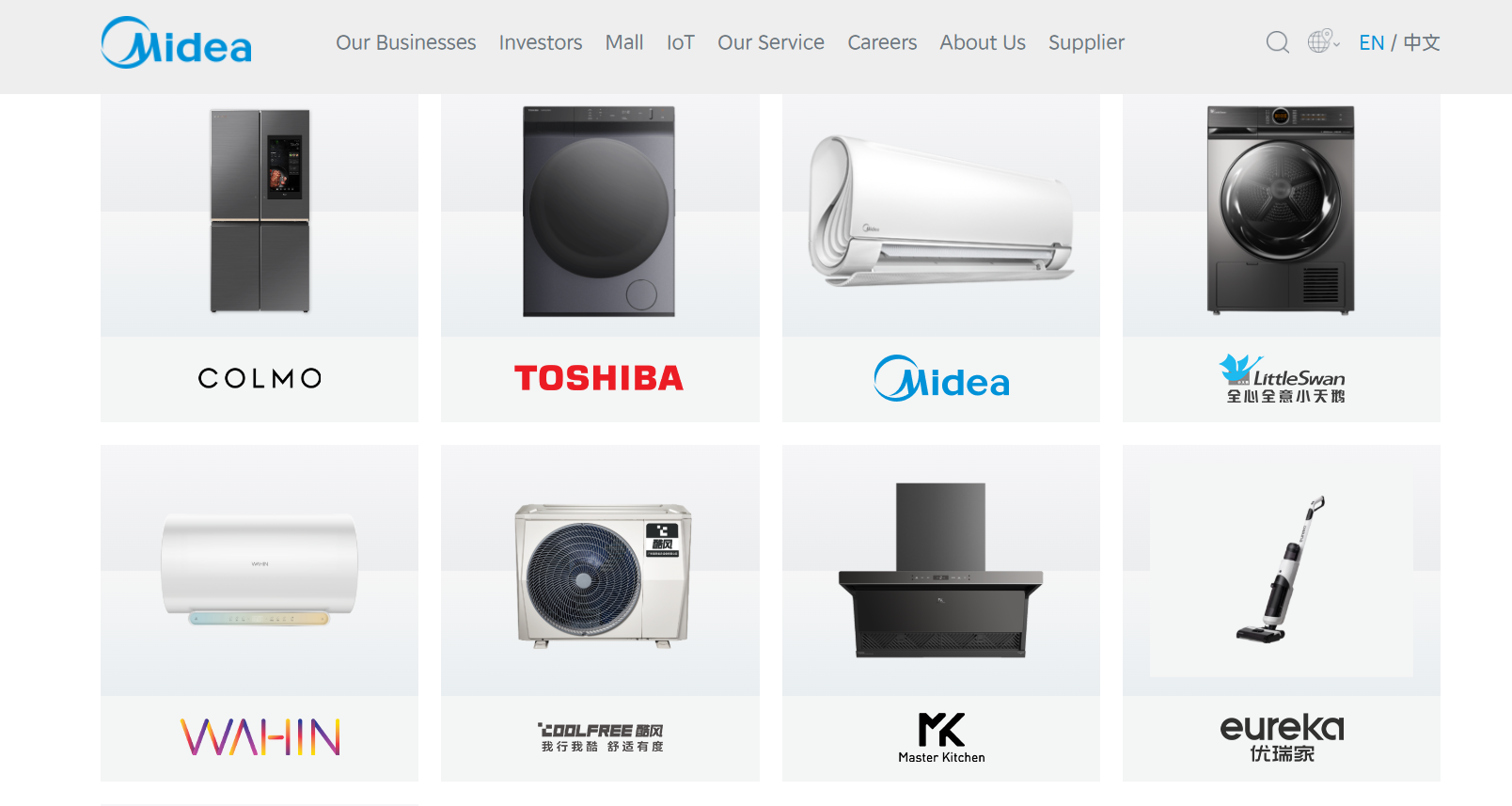

7. Midea Group: The Vertically Integrated Manufacturing Titan

The technological giant in the cleaning appliances industry:

Midea Group is a global appliance behemoth whose core strength is unrivaled vertical integration and economies of scale. It controls a deep supply chain, from compressors and motors to injection molding. In cleaning appliances, it is not only a major brand owner but also a vital one-stop manufacturing solution provider capable of servicing the full market spectrum.

Market Dominance and Strategy:

Midea executes a dual strategy of "direct-to-consumer brands and global manufacturing services." It competes with its own brands (Midea, Toshiba) while leveraging its global production footprint, mature quality systems, and R&D prowess to provide reliable manufacturing for international companies. Its competitiveness is rooted in decades of full-industry-chain expertise, automated production experience, and a profound understanding of global market standards.

Core Products and Services:

Full-Category Appliance Manufacturing: Produces complete lines of robot vacuums, cordless vacuums, floor washers, and more.

In-House Core Component Production: Mass-produces key components like motors, PCBs, and battery packs, ensuring supply chain security and cost advantage.

Global Manufacturing and Fulfillment: Offers localized, responsive production and logistics through a worldwide network of "lighthouse" factories.

![Midea Group]()

8. Haier Group: The Globalized Smart Living Platform

Globalization Cleaning Appliances Research and Development Center:

Haier Group is a world-leading smart home solutions provider. Its manufacturing distinction is "user-scenario-driven flexible production" enabled by a globalized resource-synergy network. Through acquisitions like GE Appliances and Fisher & Paykel, Haier boasts an R&D and manufacturing footprint across all major markets. It designs and manufactures cleaning appliances not just as standalone products but as integrated nodes within a broader smart home ecosystem.

Market Dominance and Strategy:

Haier's strategy is "Global R&D, Global Manufacturing, Global Marketing." It establishes R&D centers and COSMOPlat-enabled "smart factories" in key regions (China, USA, Europe), allowing for rapid localization of products to meet specific regional habits and demands. This platform facilitates large-scale customization, offering greater flexibility to global partners and end-users.

Core Products and Services:

Premium Smart Cleaning Appliance Manufacturing: Focuses on producing connected robot vacuums and cordless vacuums with features like auto-empty docks and premium materials.

Integrated Smart Home Solutions: Provides cleaning devices designed to interconnect seamlessly with Haier's ecosystem of appliances (refrigerators, air conditioners, etc.).

Global Technology and Manufacturing Export: Exports its intelligent manufacturing model and standards across its worldwide network.

![Haier Group]()

9. Anker Innovations: The Brand-to-Tech-Enablement Pioneer

A mature cleaning Appliances system:

Anker Innovations charted a unique path from a successful cross-border e-commerce brand to a firm with strong in-house R&D and product definition capabilities. It is not just a brand owner but a sophisticated manufacturing and development entity that deeply understands global market needs and executes rapid productization of innovative tech. In cleaning, its sub-brand eufy exemplifies how it replicates its consumer electronics success in smart home.

Market Dominance and Strategy:

Anker employs a "R&D + Brand" dual-engine model focused on a "Shallow Sea" strategy. Instead of competing in vast, saturated markets, it focuses on achieving leadership in specific, deep niches like intelligent charging, smart home (cleaning), and audio. Its manufacturing is tightly aligned with this strategy, supporting a fast-iteration, pain-point-focused product development cycle and go-to-market through a global multi-channel network (Amazon, independent sites, retail).

Core Products and Services:

Premium Own-Brand Product Manufacturing: Manufactures products for its portfolio brands (Anker for charging, eufy for smart home/cleaning, Soundcore for audio).

Technology Solution Licensing: Offers licensing or partnership opportunities for its patented tech in fast charging, AIoT, and home energy storage.

Global Brand Operations & Supply Chain: Manages a direct-to-consumer channel reaching over 200 million global users and a mature cross-border supply chain.

![Anker Innovations]()

Conclusion: A Market Forged by Innovation and Specialization

The Chinese cleaning appliance market in 2025 is a mature ecosystem characterized by distinct and successful strategic paths. The dominance of companies like Roborock, Ecovacs, Lincinco, and Dreame on the global stage is no accident. It is the result of a deliberate shift from competing on cost to competing on proprietary technology, category creation, and brand building.

Roborock exemplifies an algorithm-driven, premium global strategy. Ecovacs demonstrates the power of vertical integration and brand diversification. Tineco proves that inventing and owning a new category is the ultimate competitive advantage. Dreame shows how technological disruption and targeted international focus can drive hyper-growth. Meanwhile, manufacturers like Lincinco underscore the critical importance of specialized, scalable manufacturing expertise that supports the entire industry.

For businesses, retailers, or investors looking to engage with this market, the key takeaway is specialization. Success lies in identifying partners or competitors not just by their products, but by their core strategic competency—be it software, supply chain control, category vision, or pure engineering might. The future of home cleaning is being written by these Chinese leaders, and their influence will only continue to expand globally.